Free Trade Zone ≠ Logistics Zone? A Complete Guide to FTZ Operations

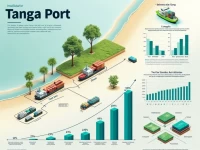

This article compares bonded zones (duty-free areas for processing/re-export) and logistics parks (focused on storage, distribution, and multimodal transport). Both play vital roles in facilitating global trade through specialized functions.